What is a better investment?

This is one very common question and often one that surprises people when I answer.

First, there is no right or wrong option here and we certainly are not comparing apples with apples.

Personally, I do believe there is a lot of noise when it comes to the property market because interest rates are so low which makes borrowing easier. And let’s face we are in a world where instant gratification is expected daily so when looking to build a million-dollar managed portfolio from the ground up, can seem like a big unachievable goal. However, to borrow money to buy a property is achievable.

But the outcome for each can be different so I am going to first look at property versus a managed portfolio.

Year in and year out both investment types will vary due to economic influences.

Property:

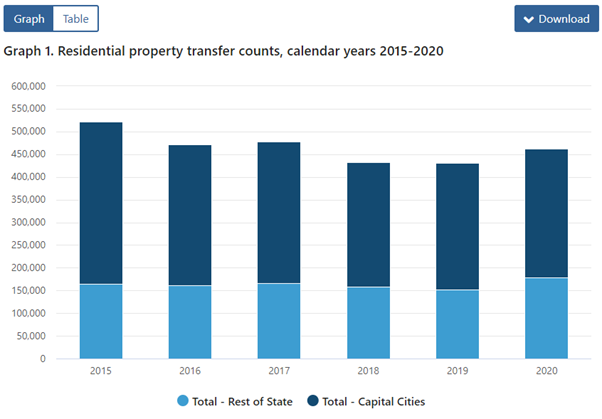

The average property growth over the past 6 calendar years (2015-2020) has been 6% for capital cities and 4% for the rest of the state (source www.abs.gov.au).

To many people, property seems to be the obvious choice to invest. If geared negatively (meaning you have borrowed funds to buy and owe more toward the loan on a given year than the annual income it generates) there are tax advantages.

When positively geared (meaning you owe less money on a given year than the income it generates) would mean you are receiving a passive income from your investment.

Both outcomes can be a win win depending on your situation.

Property investing (in the right area and type of property) can return you a handsome income. But you must do research. Understand the cost to property management (use a trusted real-estate) and be aware that property upkeep and times the property untenanted can be an expense to the investment. Be aware that there is work involved when investing in property. When looking at buying property you need to get clear on what the objective is for the property – is it to deliver you a passive income? Are you wanting a high rental yield? Or are you after long term growth? Some capital cities in Australia will return a great rental return, yet the long-term growth does not stack up in comparison to other capital cities.

Funds:

If you are after a more set and forget investment, then investing in a funds would be more suitable.

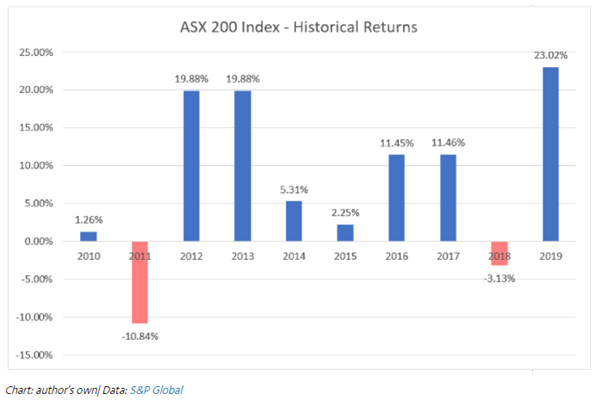

On average the ASX200 has returned 10% over the past 10 years. This is more growth than property, but arguably more volatile. When it comes to investing in the markets, we at Rekab Advice mix things up so my clients are not just exposed to one asset class (such as Australian shares). We create a modelled portfolio which would consist of Australian shares, Australian property shares, international shares, international property, Fixed interest, bonds, and alternatives. This mix allows the investor to be invested across multiple asset classes.

Both asset types are long term – there is no get rich quick scheme here – also you need to consider tax upon the sale of the asset, all of which must be considered.

As an adviser my goal is ultimately to ensure my client gets the return they need. In most cases I have found investing in a modeled portfolio the way forward for superannuation and retirement savings. Why?

It does not cost as much as property (in terms of ongoing costs) and does not require ongoing upkeep and management – outside the role of the adviser and fund managers.

I suggest you first set out some clear goals and objectives.

It’s always worth speaking to a financial adviser like myself. There are plenty of strategies out there that can really help you accelerate on your wealth creating journey – my job is to know what you are after and create a plan so it can be achieved.

Borrowing to build your wealth:

I touched on the topic that that in Australia interest rates are low at moment, therefore borrowing money to build wealth can be a great way forward…. especially when the expected growth of the asset is expected to be more than the interest. Often people borrow to buy property, but you can borrow to enhance your investment portfolio as well. One strategy is to use some of the equity in your home loan to re- draw funds to invest. Please be mindful that there are risks when it comes to borrowing and investing and you should seek professional financial advice and also speak to a lending specialist about your options.

The above graph is just an example of a portion of what is in our managed portfolios, but this data was too good not to share. When I say managed portfolio, I am speaking of a fund that is diversified and constructed to deliver returns even in a volatile market. The portfolio would consist of a portion of Australian Shares (like above), international shares, Australian bonds, international bonds and property.

This past 12 months the Rekab Advice Growth fund returned 25% (from May 2020 to May 2021), now this was quite high and although we are very proud of this return, we don’t expect this to occur year in year out.

There is no time like the present. Whether you want to enhance your current investments with your retirement savings or want to build wealth or have a passive income, the key is to get on with it and seek advice.

Not sure if you know what you want but know doing nothing is not ideal then don’t be a stranger, select a time here to chat with us today.

Disclaimer: This article is general in nature and has not considered your personal circumstances. We recommend you seek financial advice from a licensed adviser.