After two failed business in the financial services, a single mother of 3 children (at that time under 5), I set out to start all over again. This time setting up my own financial planning practice – after all I knew it was possible, I had managed to do if for a private firm with the promise of equity – which never eventuated. I share this because out of my mistakes have come my success through lessons learnt. With this experience and wisdom I now share my journey with the hope others can avoid the expensive experiences and hardships I faced – of which were avoidable had I valued myself, my time and my skills and had I planned carefully with clear intention of what outcome I desired for my business, my finances and my family.

Money Matters……

Many women who come to me for financial advice often seem to have it all.

They have the well-paying job, may be even an investment property but they don’t feel like they have control over their finances or financial future. The common issues most face is confidence when it comes to managing their money. More often than not, their banking process is over complicated and in many cases they are not clear on their financial goals, confused by the noise of other people’s opinions and values.

So here are some key points I raise with my clients:

Keep it Simple.

Bank accounts are financial products. Many people I see have numerous accounts and over complicating the simple method of saving and budgeting.

You need one everyday account for income and expenses (and if you have a mortgage I recommend this be your offset account).

And One Savings Account

Know your fixed costs and pay them when you get paid

Don’t wait for your quarterly electricity bill to be posted to you. Work out what your bills are and how much you need to commit to in your pay cycle. By doing this you will

- Be in control of your bills (most likely be discounted for paying on time).

- You will know your true “Net Worth” (to be clear this can be referred to as “disposable income” however let’s be real here who disposes their income???? I seriously advise against this 😊

- Knowing what you have to “play with” after your expenses are covered will give you greater sense of control. You will know whether you can afford to spend $200 on Saturday night out with friends or if you can join the local gym or perhaps commit to further reducing debt or increase your savings goals…. YOU ARE IN CONTROL HERE…. It is your money.

- Invest in your future:

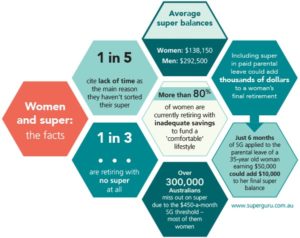

Savings versus Investing – Educate Yourself. Set clear goals and work on a plan to grow your wealth. The most tax effective form of investing is in your super. I know with the royal commission, some of you may have lost faith in superannuation.

I get the process of moving from a salaried income to being self-employed will have its challenges when it comes to the above mentioned key points so with that said you need to pay attention to my next point:

Cash Flow is King When it Comes to Business

Here are some tips on how to combat this….

1. Have a business plan.

Have a clear vision on what you want. Be clear about your “Why”. I am sure many of you have done this exercise and this seems so simple, be prepared to change your plans. Review your plans annually. As you grow this may need to be reviewed twice a year.

2. Know your expenses.

Whether you are selling a product or a service you need to know how much you will need to earn to break even, pay GST and tax. The best way is to think about your expenses first.

Set a company budget, and then you will know how many units or clients you need to see each week, month, quarter.

3. Track your income and expenses so you know your cash flow position.

It can be so easy to get in over your head with expenses, especially the miscellaneous variety, such as software subscriptions, online courses and marketing.

I have spreadsheets I can share with you, just send me an email. However if you can afford it I recommend you set up Xero, MYOB or QuickBooks… there actually a few great bookkeeping software out available online….and talk to your accountant about this. I would also discuss with your accountant the best way to structure your business. You may start off as a sole trader, then register for GST as income rolls in, then set up as a company. Be aware and always get advice.

4. Invest in yourself. Invest in your future.

Now you are no longer employed, therefore your super may be neglected. Don’t let this happen. Pay yourself first by contributing to your super, and then put money aside for Tax and GST, then the rest is yours to play with. But Super first! It is either going to your super or the ATO, so why not invest in you first?

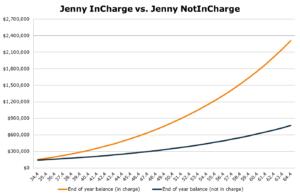

Here is an example of Jenny InCharge verses her friend Jenny NotInCharge (I know I am very original).

I am going to share some statistics about gender gap issues and how this has impacted on female’s retirement savings soon, however just looking at these figures you will see that NotInCharge would also represent women on maternity leave….

I come across many self-employed clients, and the one issue they have is they don’t have enough to retire on because they never put themselves first.

You must invest in yourself. No one else will.

I know you already have bought into the notion of investing in yourself otherwise you wouldn’t be backing yourselves and starting up your own business.

Don’t get me wrong, a successful business can be a great asset. I don’t want to put fear in anyone, however it can take time to get your money-making machines formula right. So ensure you’re paying yourselves first. And to do this you need to manage your cash flow.

It won’t happen overnight but it will happen.

The Power of Paying yourself first…..using your super

You can see the difference here, how important it is to pay yourself first.

With recent changes in super, you can make concessional contributions (that is pre-tax contributions) to your chosen Super fund.

As you begin to earn revenue, I suggest you contribute 10% of this to your super (this will offset 10% of your tax liability). Be sure to put 10% away for GST (if you are already registered for GST) and a tax savings buffer, this will vary according to your expenses and income.

Your GST will be offset with some of your expenses, over time it will become easier to estimate these figures each quarter and if you are using bookkeeping software such as Xero, MYOB or QuickBooks you will be able to forecast these figures as you earn and spend.

My advice is get advice. If you use a bookkeeper communicate with them. Talk to your accountant and educate yourself. This is your money, your business. Here is a helpful website I came across: www.flyingsolo.com.au/finance/business-tax-tips.

There are plenty of tools on line which will help you.

Get to know Your Super

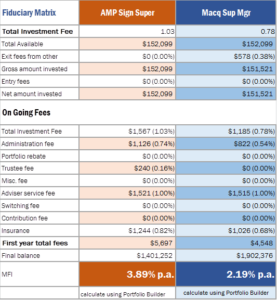

You may have seen on the news that the royal commission lifted the lid on superannuation fees…. Now this is not news to me. I am constantly showing my clients how much they are paying for their super to be managed.

My client (female in her 30’s) currently has an AMP fund which her employer set up years ago.

She had insurance, paid an advice fee (but did not have an adviser) and of course investment fees… every fund that has money invested will have investment fees. These fees will vary based on the investment. Then there are management or account fees.

I did a comparison with a competitor and changed the investment strategy to ensure investment objectives are met – as you can see this significantly changes the how much she would pay in fees and as a result increase her super savings by $501,124.

Be aware of how your money is managed and invested.

Do you know how much you need to retire with? In this case my client has decided she would be comfortable with $2 Million. With the investment strategy I have created she will most likely meet this objective.

This will need to be reviewed annually to track progress, but also to ensure this is still the same goal. I assure you, as you grow in your careers, your wealth and business, the vision you have for your future will also evolve so make sure you are being pro-active with your investment.

Be Aware of how you’re invested.

Be aware of who is managing and investing for you and are they clear about your objectives?

Be aware of your risk tolerance.

Understand your risk exposure and invest accordingly.

Review your goals often.

If you need more information on understanding your risk profile, or how super works drop me a line. I have a lot of free material I can send you.

So now looking at this case study of my client, after I reviewed her super fund and now had an understanding of her objective we made a few small changes, like increasing her insurance because her income was much higher than it was insured for, changing her investment and the fund to Macquarie. Macquarie Super is part of Macquarie Wrap this means my client or myself can create an investment portfolio with a wide selection of investments.

In this case I am investing my client in a Managed account which on average returns 10% per annum. So, the figure at retirement will meet her personal objective being that she wants to retire at $2million.

Now don’t get me wrong, I don’t come with a crystal ball. I can only forecast future values based on past performance…Take note of this disclaimer 😊

If you think back to the GFC, Super balances recovered quite quickly. It was not all the doom and gloom that was created at the time. The GFC created positive changes creating a far more transparent finance industry (despite what is happening right now with the Royal Commission – of which in my opinion should have happened during the time of the FOFA reform (future of financial advice).

The above slide is shows the GFC, but it also demonstrates how the markets did eventually bounce back. At the time, it was doom and gloom. It was a financial catastrophe…. But looking back, it was only a small period in time.

This chart is a reminder of how we must keep a focused mindset when it comes to investing and building a business.

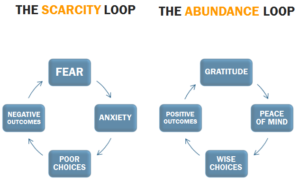

As a business owner you will experience ups and downs. But my advice to you is to continue to focus on the positive outcome of the work you are doing. Keep an abundant mindset….

An abundant mindset

Do not fall into the trap of fear…. This only causes panic and a spiral of scarcity.

Running a business is like a marathon, it takes a strong will, a mindset, focus, tenacity.

Be deliberate with you action and clear minded when making decisions in your business.

Be accountable.

Make sure you have mentors. If you don’t, find them. Take them out to lunch. I have had several mentors over the years. One of which gave me some very good lessons which I carry with me today…..

Never be the smartest person in the room…. If you find another room. We need to constantly be learning in order to evolve….. And then pass it on. There is no real competition out there, specially for women in business. I network with my fellow “competitors” other female advisers – 1. Because we can encourage each other. 2. Because the more good we all do means the public will see our value. 3. They may have strengths and knowledge I can also take on and use in my practice.

Never be the smartest person in the room…. If you find another room. We need to constantly be learning in order to evolve….. And then pass it on. There is no real competition out there, specially for women in business. I network with my fellow “competitors” other female advisers – 1. Because we can encourage each other. 2. Because the more good we all do means the public will see our value. 3. They may have strengths and knowledge I can also take on and use in my practice.

If you’re a pioneer who has created a new service or technology, get out there and involved in communities like TSL. You never know who would be prepared to invest in you.

Are you a child or an Adult????

Another lesson I learnt from this mentor is this simple way of being accountable. Keeping your mindset right and good decision making:

ADULT THRIVES

Mistakes = lessons learnt, Accountable

Supports others

_______________________________________

CHILD SURVIVES

Mistakes = Excuses, blames others, lacks wisdom,

Depends on others

When problems arise in business, where do you sit? I must admit. I used to blame, offer excuses and not really sat above the line.

So, where you do sit?

When it comes to your finances, are you giving excuses? Is your head in the sand or are you being accountable for your finances?

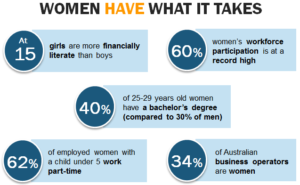

Celebrate being a Female Entrepreneur

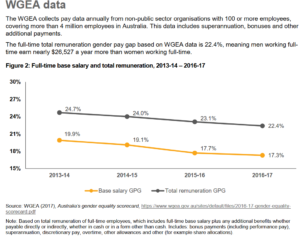

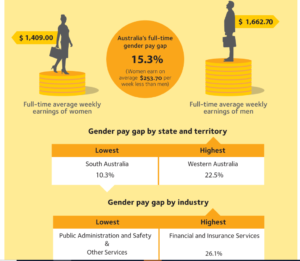

It is incredible to be here in these times. We are still dealing with gender pay gap issues…… (not to mention retirement saving issues)

You don’t – so long as you are billing and contributing equal to your male peers.

But you ladies are in a position of opportunity.

It is quite incredible.

Let’s quickly look at the problem women are facing in the work force today:

As you can see we have what it takes so let’s change these statistics

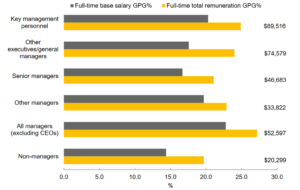

Unfortunately, I am in the financial services industry.

Females in advice seem to be an endangered species…. Last year the GPG was 30% (Gender Pay Gap).

At an industry event State Street Global shared a white paper on the issues we face in the financial services on the topic of Females in advice, a lot of very great references were offered that would impact not only my industry but all industries if change is made. But it is up to us to push for change.

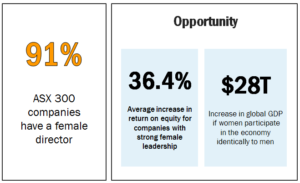

What is the Opportunity?

That 3rd figure is up to us. We are the leaders here.

If you are in a full-time employment position it is up to you to raise your hand for the promotion and pay raise.

Be aware of your value.

Share your knowledge with others…. Pay it forward.

I was at a presentation yesterday afternoon, so I thought I would add this as it was interesting to me. For most of you, you would be in the 5% of self-employment. It goes to show how important it is for us to band together as women, to network, to be mentor and collaborate with each other, it will only make a stronger community.

If Sydney were 100 women…

31% would have a university degree, and 8% would currently be studying for one

30% would work full time

5% would own a business

27% of those who work would take public transport to get there

18% would have performed volunteer work in the last year

15% would earn over $100K per year

48% would earn less than $34K per year

54% would be in paid work (compared to 65% of men)

Be the change you want to see

I feel this is the best place to finish this off. It is apparent we all have the power to make change.

Firstly for ourselves, be in control of your financial future and you will be able to contribute positively to future of others in so many ways.

If you need any additional information please don’t hesitate to ask me.

If you would like to sign up to my personal cash flow challenge please sign up to register.